does indiana have a inheritance tax

Here in Indiana we did have an inheritance. Indiana used to impose an inheritance tax.

If you have received an inheritance or know you will be receiving one and live in one.

. As a result the Michigan Inheritance Tax is only applicable to people who inherited from a person. This tax ended on December 31 2012. Indiana previously had an inheritance tax but it was repealed in 2013.

However other states inheritance laws may apply to you if someone living in a state with an. Indiana repealed the inheritance tax in 2013. Inheritance tax was repealed for individuals dying after December 31 2012.

An inheritance tax is a state tax that youre required to pay if you receive items like property or money from a deceased person. Indiana repealed the inheritance tax in 2013. Indiana has a three class inheritance tax system and the exemptions and tax rates.

An inheritance tax is a state tax that youre required to pay if you receive items like property or money from a deceased person. In 2021 the credit will be. In 2021 the credit will be 90 and the tax phases out completely after December 31 2021.

For deaths occurring in 2013. No inheritance tax returns Form IH-6 for Indiana residents and Form IH-12. The Inheritance tax was repealed.

No inheritance tax returns Form IH-6 for Indiana residents and Form IH-12 for. How Much Tax Will You Pay in Indiana On 60000. There is no inheritance tax in Indiana either.

Up to 25 cash back 7031 Koll Center Pkwy Pleasanton CA 94566. The Michigan Inheritance Tax is still in effect even though the tax was eliminated in 1993. Thus there is no Indiana.

Get Help For Your Inheritance Tax. No inheritance tax has to be paid for individuals dying after December 31 2012. At this point there are only six states that impose state-level inheritance taxes.

Indiana does not have an inheritance tax. Does Indiana have inheritance tax 2021. Indiana Inheritance Tax is imposed on the transfer of property from an Indiana decedent to a beneficiary.

Good news for Hoosiers doing their estate tax planning. Indiana Inheritance and Gift Tax. On the federal level there is no inheritance tax.

County Clerk Decatur County Indiana

Per Stirpes By Representation Per Capita What Do They Mean Russo Law Group

Estate Planning Facts An Overview Of Indiana Inheritance Laws

Dor Keep An Eye Out For Estimated Tax Payments

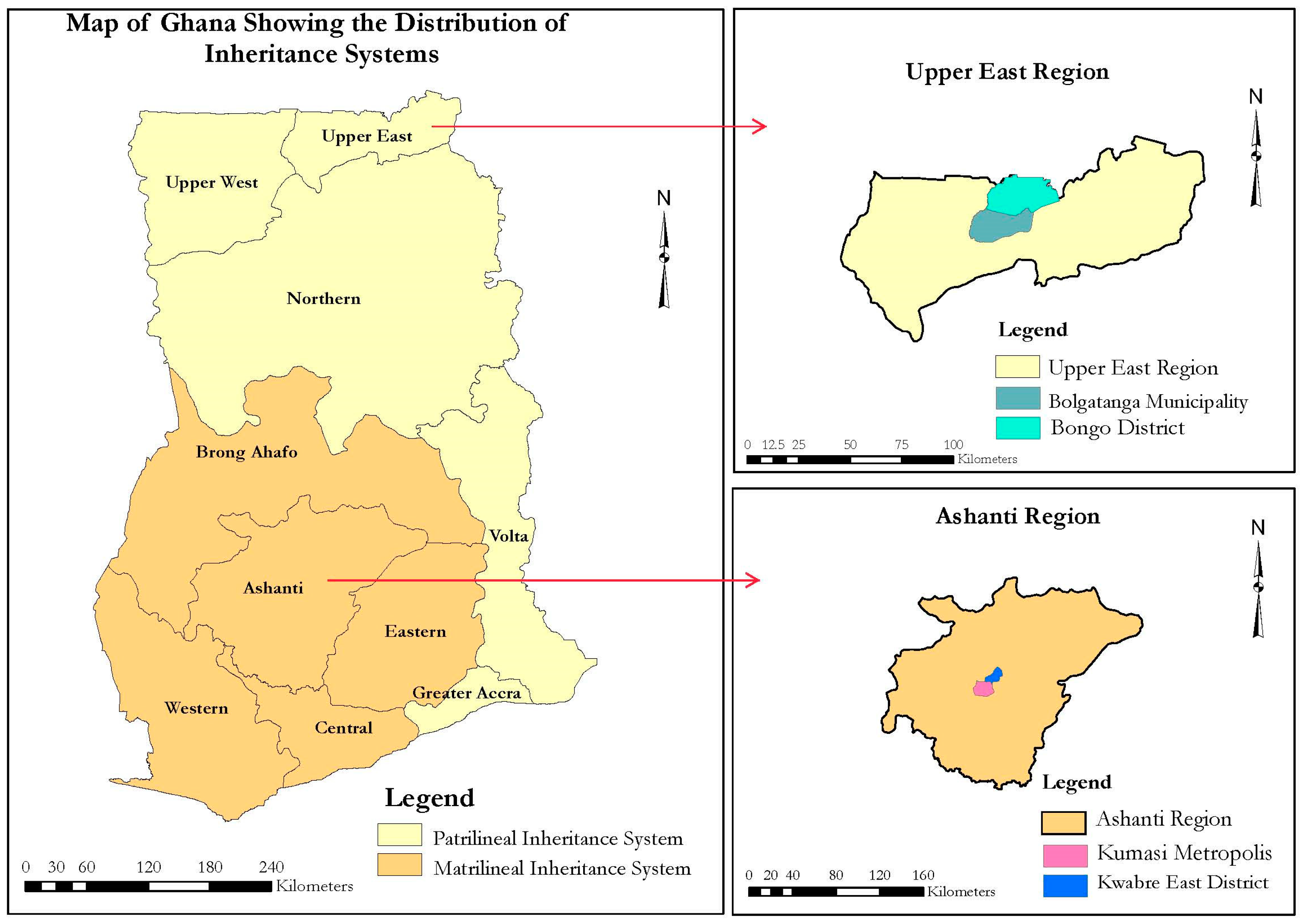

Sustainability Free Full Text Plural Inheritance Laws Practices And Emergent Types Of Property Implications For Updating The Land Register Html

How Do State And Local Sales Taxes Work Tax Policy Center

Dor Need A Payment Plan Set It Up In Intime

How Do State And Local Sales Taxes Work Tax Policy Center

Indiana Income Tax Calculator Smartasset

Indiana Income Tax Calculator Smartasset

Inheriting A House With No Mortgage Probate Advance

Complete Guide To Probate In Indiana

Complete Guide To Probate In Indiana

/personal-finance-lrg-2-5bfc2b1fc9e77c00517fbebb.jpg)